The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

The Basic Principles Of Mileagewise - Reconstructing Mileage Logs

Blog Article

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

Table of ContentsMileagewise - Reconstructing Mileage Logs for BeginnersLittle Known Questions About Mileagewise - Reconstructing Mileage Logs.An Unbiased View of Mileagewise - Reconstructing Mileage LogsWhat Does Mileagewise - Reconstructing Mileage Logs Mean?The 5-Minute Rule for Mileagewise - Reconstructing Mileage LogsGetting My Mileagewise - Reconstructing Mileage Logs To WorkFascination About Mileagewise - Reconstructing Mileage Logs

Timeero's Fastest Distance attribute recommends the fastest driving route to your workers' location. This feature improves performance and contributes to cost savings, making it an essential asset for organizations with a mobile workforce. Timeero's Suggested Course attribute further improves liability and performance. Employees can compare the recommended course with the actual course taken.Such a strategy to reporting and compliance streamlines the typically complex job of managing gas mileage expenditures. There are several benefits linked with utilizing Timeero to monitor gas mileage. Let's have a look at some of the application's most noteworthy functions. With a trusted mileage monitoring device, like Timeero there is no requirement to stress over mistakenly omitting a date or piece of details on timesheets when tax time comes.

Not known Factual Statements About Mileagewise - Reconstructing Mileage Logs

These added confirmation measures will certainly maintain the IRS from having a reason to object your mileage records. With accurate gas mileage tracking technology, your staff members do not have to make harsh mileage price quotes or also stress regarding mileage expenditure monitoring.

If a worker drove 20,000 miles and 10,000 miles are business-related, you can write off 50% of all vehicle expenditures (best free mileage tracker app). You will need to proceed tracking mileage for work also if you're making use of the actual expense technique. Keeping mileage documents is the only way to different company and personal miles and supply the evidence to the internal revenue service

Many mileage trackers allow you log your trips manually while computing the range and compensation amounts for you. Several additionally included real-time trip monitoring - you need to begin the app at the start of your journey and stop it when you reach your last location. These applications log your beginning and end addresses, and time stamps, together with the overall range and repayment quantity.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Talking About

One of the concerns that The IRS states that car costs can be thought about as an "average and essential" cost during doing organization. This consists of costs such as gas, maintenance, insurance coverage, and the automobile's devaluation. For these prices to be considered insurance deductible, the car ought to be utilized for business objectives.

Excitement About Mileagewise - Reconstructing Mileage Logs

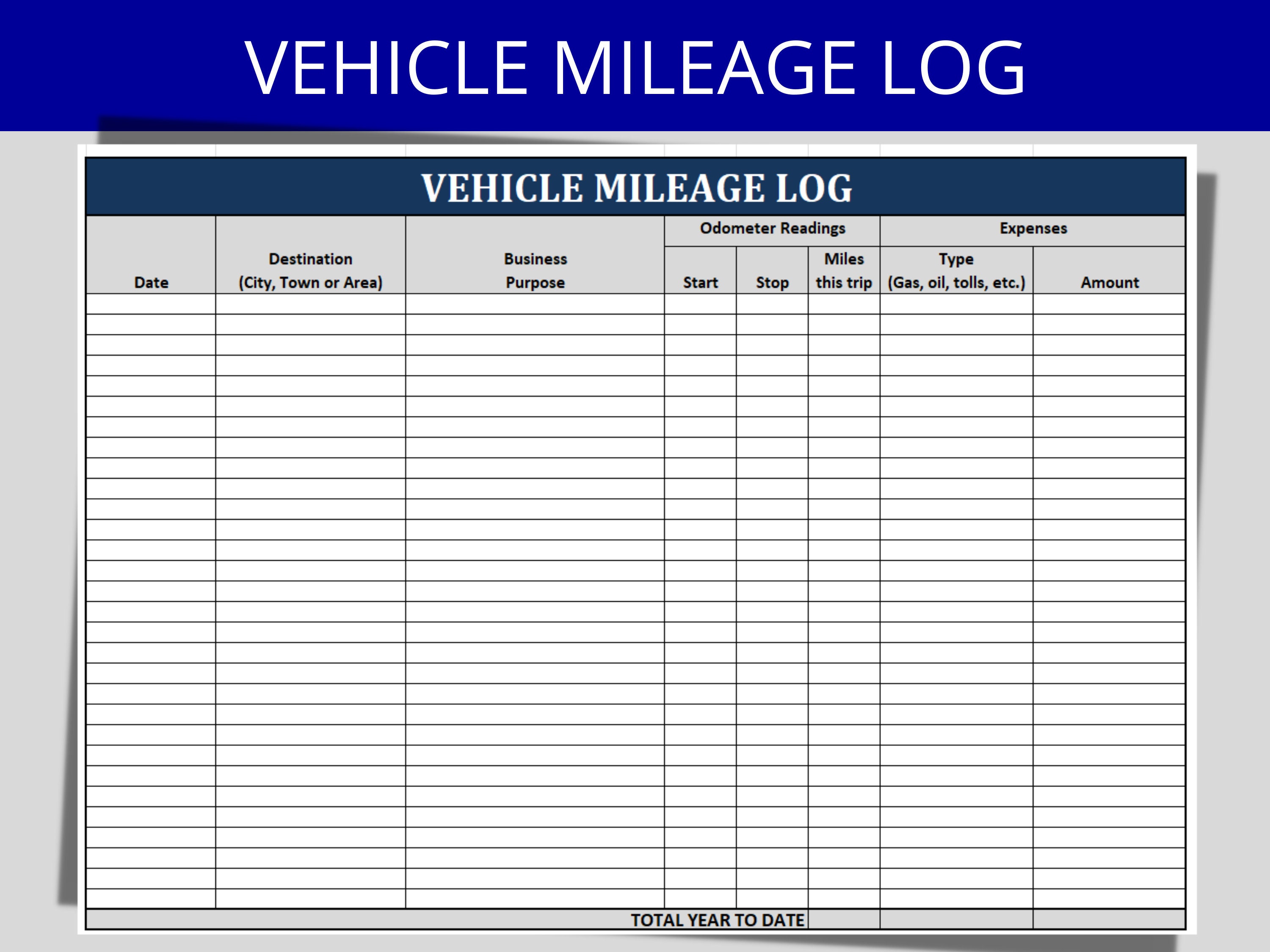

Begin by recording your auto's odometer analysis on January 1st and after that once again at the end of the year. In between, carefully track all your service trips noting down the beginning and finishing readings. For each trip, document the area and organization function. This can be simplified by keeping a driving visit your vehicle.

This consists of the total organization mileage and total mileage buildup for the year (business + individual), trip's date, destination, and objective. It's vital to record activities promptly and keep a simultaneous driving log outlining day, miles driven, and organization purpose. Below's how you can enhance record-keeping for audit objectives: Start with guaranteeing a meticulous mileage log for all business-related traveling.

Mileagewise - Reconstructing Mileage Logs for Dummies

The real costs method is an alternate to the common mileage price technique. As opposed to calculating your reduction based upon an established price per mile, the real expenses method enables you to deduct the actual expenses associated with utilizing your car for business functions - best mileage tracker app. These costs include fuel, upkeep, repairs, insurance policy, devaluation, and various other related costs

Nevertheless, those with significant vehicle-related expenses or unique problems may take advantage of the actual costs approach. Please note choosing S-corp status can alter this computation. Eventually, your picked method should align with your specific economic objectives and tax obligation circumstance. The Criterion Mileage Price is a step released every year by the internal revenue service to establish the deductible expenses of operating an automobile for service.

What Does Mileagewise - Reconstructing Mileage Logs Mean?

(https://www.gaiaonline.com/profiles/mi1eagewise/46919649/)Compute your total company miles by using your beginning and end odometer readings, and your videotaped company miles. Precisely tracking your exact gas mileage for company journeys help in substantiating your tax reduction, particularly if you choose for the Requirement Gas mileage method.

Keeping track of your mileage manually can call for persistance, but keep in mind, it might conserve you cash on your tax obligations. Videotape the complete mileage driven.

Things about Mileagewise - Reconstructing Mileage Logs

And now nearly everybody makes use of General practitioners to get around. That suggests almost everybody can be tracked as they go concerning their organization.

Report this page